For years, data center development was concentrated in just a few key U.S. markets, as well as a handful of international locations including Singapore, Amsterdam, London, and Dublin, where tax incentives, power supply, building options, and contractors were reliable and accessible. But all of that is changing. Demand for new development is shifting into non-traditional markets where the path to securing permits, land, and power is less clear.

Growth Drivers

There is a shifting preference internationally from on-premise data centers to colocation centers and cloud providers. The reallocation of enterprise servers between cloud platforms, colocation facilities, and on-premises data centers is definitely a growth driver. But the larger drivers of data center growth in non-traditional international markets are performance and regulation

Regulation

Most every developed nation across the globe has, by now, adopted data localization or sovereignty laws requiring that a country’s citizens’ data be stored on physical servers within the country’s borders. The EU’s general data protection regulation (GDPR) drew a lot of attention when it was enacted two years ago, and other countries have followed suit.

Data sovereignty also makes sure that a country will not lose control or sovereignty over the processing of personal data that concerns citizens of that country. Layer on top of that industry-specific regulations for governments and financial institutions, which dictate that data be stored close to the point of use and companies are scrambling to build or lease space in centers close to their operations.

The Race Is On

Data center development is entering new frontiers the world over. Countless announcements this year alone – even in the throes of a global pandemic – prove the urgency with which countries and companies are building data centers.

As we look around the globe, we see governments in non-traditional markets making a big push for data center development:

- The Middle East – A report released late last year by the Arab Advisors Group found that Middle Eastern data centers are being built more frequently than in previous years, with a preference toward colocation facilities. Increased government support for the digital economy in the region, the growth in cloud adoption, and migration from on-premise infrastructure to colocation and managed services are expected to drive the data center investment in countries comprising the area.

- Africa – Africa’s Data Centres Association (ADCA) recently released its first research paper in which it notes high expectations for data center development. Data Centers are being positioned as a «catalyst for economic transformation» across Africa, with at least 20 new facilities coming online between 2020 and 2021. Data loads on the continent are growing 100% year over year.

- Latin America – The high adoption of cloud computing, big data, and IoT services, along with the growth in social networking and demand for online video services, has prompted the need for more compute power and data storage capacity in Latin America. Brazil dominates the big data market, followed by Mexico and Colombia.

Success in New Frontiers

Entering a new country requires a commitment to doing the hard work of understanding each country’s means and methods of development. Site selection, site acquisition, permitting, and zoning are more challenging in these new frontiers. Finding the right in-country partner and developing a strategic approach in partnership with in-country experts who are well-equipped to navigate national and local rules and regulations is key.

Success also requires a healthy supply chain that can service your needs beyond the U.S. builders who lean heavily into building information management for two- and three-dimensional planning. Your overseas projects will thus benefit from faster turnaround times and less reliance on in-country expertise.

With a clear model, prefabrication also helps expedite the project delivery timeline as more pieces of the project, from power racks to walls, will be built off-site to accommodate the simultaneous assembly of key elements of the final building. Modularization and prefabrication also decrease the time spent navigating labor laws and the hiring of local crews.

Growth Curve Repeating Itself

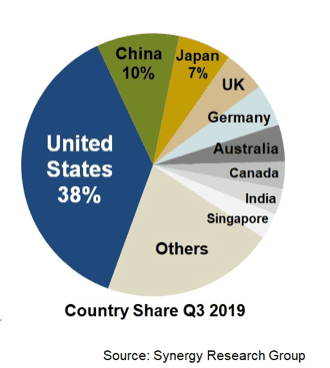

There is a cascade effect at play here. The data center building boom we’ve seen in the U.S. over the past 10+ years is unfolding in continents far and wide. According to Synergy Research Group, the U.S. is home to almost 40% of the world’s data centers, with the balance distributed among ten or so countries. Let’s check back in a year, five years and ten years to see that equation balance out as developers dive in to meet the needs of foreign businesses, consumers and governments.