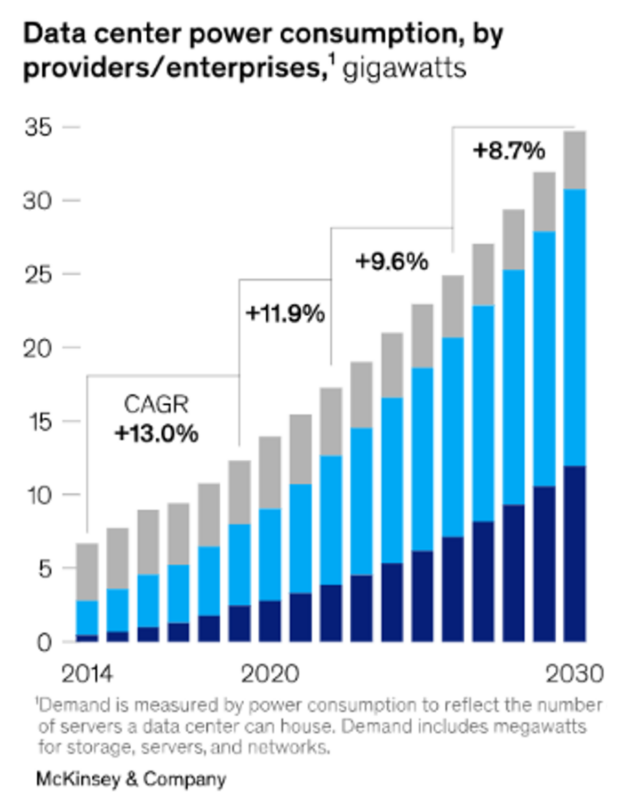

I recently read the fascinating article by the team at McKinsey & Co. called “Investing in the Rising Data Center Economy.” However, it was not the authors’ conclusions that captured my attention, but the details regarding data center demand forecast and the capital necessary to support that growth which I found so compelling. My read on their data is simple – over the next eight years, the data center sector will need to average capital investment of more than $50B annually to satiate expected demand. That is an absolutely massive number – unfathomable relative to even the most aggressive expectations just a handful of years ago – which highlights the on-going opportunity for developers like Compass Datacenters. Let’s break down those numbers.

Data Center Demand Forecasted Growth by 2030

McKinsey & Co. forecast that the U.S. market will grow in scale from 17GWs at the end of 2022 to 35GWs by the end of 2030 – an expansion of 18GWs. Further, the authors estimate that the U.S. represents 40% of global data center demand. While I would argue that over the longer-term the percent of growth from outside the U.S. will expand – as Europe, LATAM, Asia, the Middle East, and Africa become an increasingly larger focus for hyperscalers – for the purposes of this analysis, let’s run with 40%. Using that assumption, that 18GWs of growth in the U.S. translates into global growth of 45GWs in an eight-year period – which further translates into an average of 5.625GWs of annual absorption. To put this number into some historical context, it is absolutely HUGE!

Previous Data Center Demand Predictions

When I started covering the data center space as a research analyst in 2003 (first initiation was EQIX, where we projected the company would report $1MM of EBITDA for that year), tracking global absorption with any specificity was not even a possibility. By 2006-2007, we were able to track 300-350MWs of annual global absorption. By 2011-2012, the number had only grown slightly to ~400MWs, but with the broad introduction of cloud we expected higher numbers to follow.

In 2016, I was among the first to take a swing at long-range industry demand forecasts by combining cloud revenue growth forecasts with my own estimate for how much revenue a cloud company could load onto a MW of IT capacity. Determining this ratio probably deserves a post of its own – but lots of folks contributed to the effort, including a ton of industry stalwarts such as Jim Smith, Josh Snowhorn, Vinay Negpal, Peter Hopper, Chris Crosby, the CTOs from more than a dozen IAAS, SAAS, and PAAS companies, and many others.

When the dust settled, we concluded the cloud would absorb ~400MWs the following year. And, with cloud at ~50% of then market demand, we called for 800MWs of absorption in 2017. People laughed at the suggestion. By 2018, the cloud had exploded well beyond our expectations. Working at CyrusOne at that time, I updated my estimates – predicting a then-astonishing 1.2GWs of average annual absorption from 2018-2023. Looking out farther to the horizon, attempting to capture the incremental demand which AI and ML could generate, we predicted that from 2024-2035 average annual consumption would reach more than 2.0GWs. We didn’t even try to test the limits of these numbers – they were already so big that it almost didn’t matter. McKinsey & Co.’s forecast is 2.8x that last estimate.

Massive Industry Investment Necessary to Follow Data Center Demand

How much capital will be necessary to support 5.625GWs of annual absorption? In the McKinsey & Co. article, the authors highlight some work done by the Synergy Research Group – which forecasts $338B of capital investment over this same time-period and implies an average cost per MW of $7.5MM. This number seems low to me – probably a fair estimate for 2019 economics, but in the post pandemic, supply chain issue, high inflation landscape, and given the intense level of competition for land, power, and equipment, I would think a better global average number would be closer to $10MM per MW (I’d love to hear differing perspectives on the right number here). If $10MM per MW is the right number, then we are talking about an average annual spend over the next eight years of $56B+. Equinix and Digital Realty, the industry’s two largest public players, probably combine for ~$5B of annual capex – leaving another $50B+ per year of investment for the remainder of the industry to fund. I recognize that some of this will come directly from the hyperscale community but given how long I have already gone on in this conversation – I will leave that for my next post.

This article was originally published on January 27, 2023, by Jonathan Schildkraut on his LinkedIn page.